Root Proportion Decreases Under Bittensor Dynamic TAO Mechanism, Impacting Subnet Economy

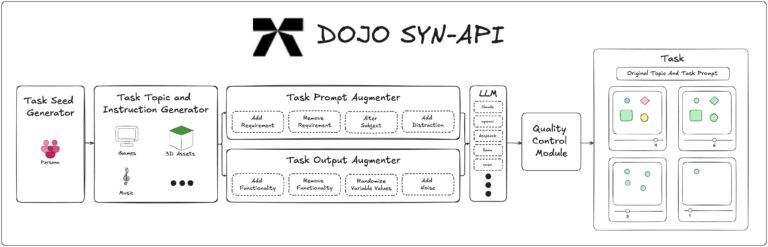

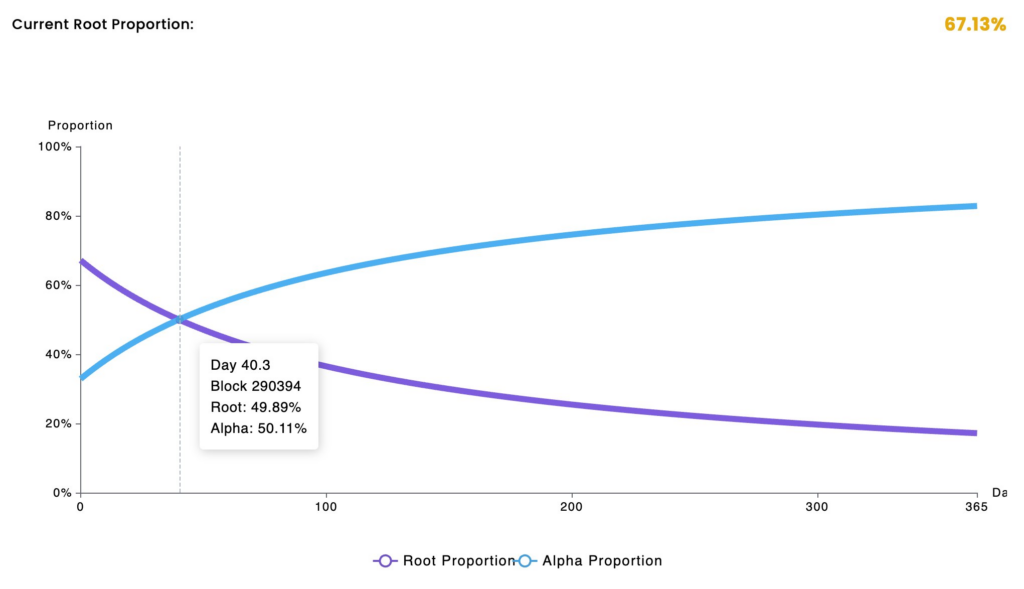

On March 28. 2025. @neuralteq posted a tweet on the X platform analyzing the change in root proportion after 6 weeks of implementation of the Bittensor Dynamic TAO mechanism. The Dynamic TAO Mechanism was introduced in January 2024 through the BIT001 proposal, replacing the centralized root network by allowing TAO holders to vote directly on the emission proportion of the subnet. According to the data provided by @learnbittensor (for example, subnet 64), the current root percentage has dropped to 67.14% and is expected to reach an inflection point within the next 40 days.

The decrease in the root ratio means that the root subnet (Subnet 0) has less of an impact on the overall emissions. bittensor’s subnets emit 2 Alpha tokens per block under Dynamic TAO, while 1 $TAO is allocated to all subnets in proportion to their emissions. The special feature of the root subnet is that TAOs staking in the root subnet are automatically distributed to all subnets, reducing risk but causing selling pressure by root subnet holders selling alpha tokens for TAOs. The chart accompanying the tweet shows a gradual decrease in the root ratio from 100% and an increase in the alpha ratio, with a 50/50 balance between root and alpha subnet emissions expected by early May 2025.

This change has important implications for market dynamics. As the Root Ratio declines, there will be less automatic selling pressure on Root Subnet holders, and Alpha tokens may gain more upside as a result.

Investors are advised to closely monitor subnet dynamics over the coming month for market entry opportunities.Bittensor’s dynamic TAO mechanism aligns economic incentives through a decentralized approach, aiming to balance risk and reward and drive long-term growth in the subnet ecosystem.