Coin Metrics Precog Subnet 55 Demonstrates Predictive Power, Outperforms Traditional Bitcoin Holding Strategies

Coin Metrics Precog has demonstrated a trading model based on subnet 55 prediction that proves to outperform Bitcoin buy-and-hold strategies on the Bittensor network. The tweet’s charts show that from January 1. 2025 to March 25. 2025. the model’s total balance (including USD and BTC wallet balances) continues to grow, especially in bear markets, and remains profitable.Coin Metrics claims that Precog is not just theory, but actionable signals.

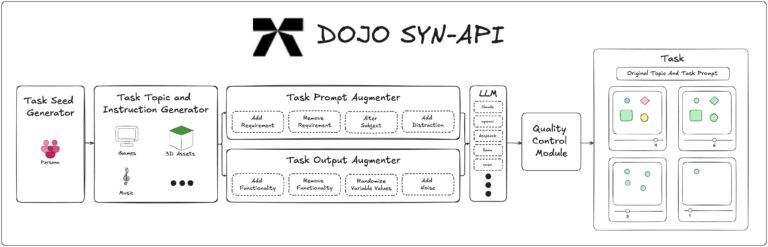

The Precog subnet 55 uses Bittensor’s decentralized AI technology to predict Bitcoin price movements and filter out noise in the price signal. According to a study in the Journal of Financial Data Science (2023), AI-driven models can reduce market noise by up to 30 percent, outperforming traditional technical indicators. It is further noted that Precog’s simulations were profitable in 15 out of 18 test windows, for both bull and bear markets, reducing risk and outperforming holding strategies, demonstrating the utility of its predictions.

1/2 Can @coinmetrics Precog forecasts power a profitable strategy?

— CM Precog Subnet #55 (@CM_Precog) April 8, 2025

We ran the test. A basic trading model using only Bittensor SN 55 forecasts beat buy-and-hold – consistently, even in down markets.

Precog isn’t theory. It’s signal.$TAO @YumaGroup pic.twitter.com/TAVncHNYpy

This result challenges the efficient market hypothesis and shows that actionable predictive signals exist in crypto markets. According to a paper in Quantitative Finance (2024), decentralized AIs are better able to exploit market inefficiencies than centralized systems.Precog’s success not only validates the potential of the Bittensor network in financial forecasting, but also provides new tools for investors.